The City of Olympia gets about 72% of its operating budget from property taxes paid by residents and sales taxes paid by everyone who buys things or pays for services here. Lately property taxes have loomed larger and larger in the budgets of residents. And as for sales tax,at 9.4% Thurston County ranks higher than 90% of other Washington counties.

Property tax

In Olympia, in August last year, the Thurston County Assessor released this statement to assuage howling homeowners who received 20% and 30% in the “value” of their homes: “Each property owner’s taxes are derived by dividing each taxing authority’s approved budget, and any voter approved measures, into the taxing authority’s total taxable value. As a result, a change in your assessed value generally has a minor effect on a given property’s taxes.”

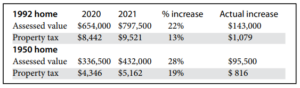

Except when it doesn’t. Sometimes, the tax increase amounted to over a thousand dollars. Take just two examples from West Olympia:

These homes are within a mile of each other in the same neighborhood in SW Olympia. The newer home was purchased for $670,000 in August of 2021—around the same time the Assessor’s “market valuation” jumped to $797,000. The older home was purchased for $62,500 in 1986—the equivalent of two public employee annual salaries at the time.

Contrary to the Assessor’s shrugging off the impacts of recent valuations, a 20 to 30% increase produced a major increase in tax liability. Even though the millage rate (fee per $1000 of property value) may diminish, when valuations jump by thousands of dollars—the tax bill grows huge as well.

For these households and many others, when the Assessor incorporates radically distorted housing prices into his calculations, it can add another $68-$90/month to an existing property tax bill in the range of $500—to as much as $1000 each month, plus the mortgage, insurance and other fixed expenses. And this goes on year after year.

Are such increases widespread? Wouldn’t elected officials want this information to make policy? Some cities do provide this information and make policy decisions based on the answers. Here’s how one city (Cambridge, MA) does it. Each year the City Manager sends all residents and taxpayers a newsletter with information about the taxes they pay. This year the letter provided this summary:

“In FY21, 59% of residential taxpayers received a property tax bill that was lower, the same as, or only slightly higher (less than $100) than the previous year, with an additional 18% of residential taxpayers only seeing an increase between $100-$250. Over the past 10 years, an average of 69.8% of residential taxpayers have seen an increase of $100 or less over the prior year’s bill. For FY22, the City will continue to work to provide stability in homeowner tax bills.

Our local government jurisdictions are the beneficiaries when property valuations increase. The property tax rate is determined according to the approved budget of each taxing jurisdiction. More transparency would serve everyone.

Sales and use taxes

Olympia’s operating budget for 2022 is $177.7 million, an increase of $10 million over last year. In addition to its share of the county-collected property tax, Olympia government gets its funds from taxes on our city utility bills (increased by 1% this year); from sales tax (29 cents from every $10 we spend here); B&O tax on businesses, taxes on telephone usage—and others. There is no one place to discover a list of taxes collected by each city in Thurston County.

In recent years, Olympia voters have approved additions to the sales and use tax rate including .1% for “affordable” housing and new expenditures for public safety.

Now the Olympia City Council is asking voters to agree to another 0.1% increase with a Special Election on April 26 to fund “cultural access programs.” The details are outlined in a 3000-word resolution that offers something for everyone—all Olympia residents and generations. Free and reduced cost programs. Neighborhood or community-based programs. Economic development (!). Arts incubation on all levels. The resolution can be found under “Special Elections” on the Thurston County Auditor page.

Regressive taxation

All of these taxes are “regressive” in that they take no account of the amount of income a household has to spend on the goods needed to live. For instance, an electricity bill of $63.78 for March includes a $5.32 payment to the City of Olympia. Heating your home, paying the telephone bill, keeping the lights on—these are challenging expenses on a working class or service wage. Tax adds almost 10% to every one of those bills.

When there’s a discussion of the need for “affordable” housing—at least, when the topic is a home that a working person in Olympia can afford—it would make sense to recognize that endlessly increasing taxes may be contributing to, rather than resolving, our housing and social crises.

Mary Jo Dolis has lived in Olympia for a long time.

Be First to Comment