This is one of two related articles for WIP; the second is about Medicare, which is also in trouble. This article gives an introduction to the problem for both, and then focuses on the problems and solutions for Social Security. Look for the Medicare article in the next issue.

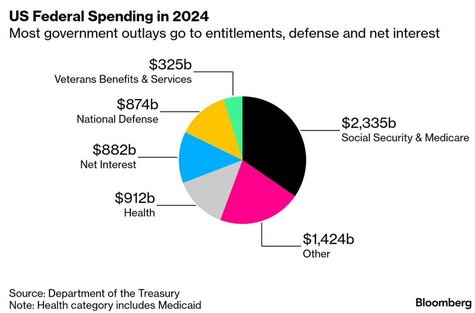

Medicare and Social Security are in trouble. These are big government programs. Social Security will pay out about $1.4 trillion this year in retirement and disability payments. Medicare will pay out about $1.1 trillion per year in hospital, doctor, and pharmacy benefits. The other “big” chunks of the federal budget are the military, Medicaid (“health”), and interest on the federal debt. Everything else is relatively minor by comparison.

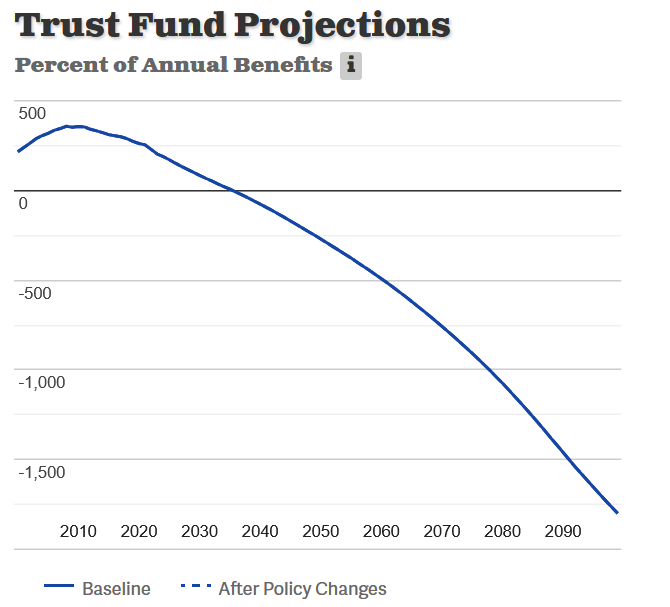

American workers pay into the Social Security and Medicare Trust Funds as a percentage of their earnings. While these are called “trust funds”, most of the money goes right back out to beneficiaries. If there is a surplus, it goes into the two “trust funds” for these programs. But the amount in the trust funds is very small relative to the amounts paid out each year, and the amount collected is less than the amount disbursed, so the balances of the trust funds are declining.

Each year, the trustees of the Medicare and Social Security Trust Funds issue a report, discussing the financial status of the programs. The most recent Medicare and Social Security reports indicate that the trust funds will be exhausted in 2033.

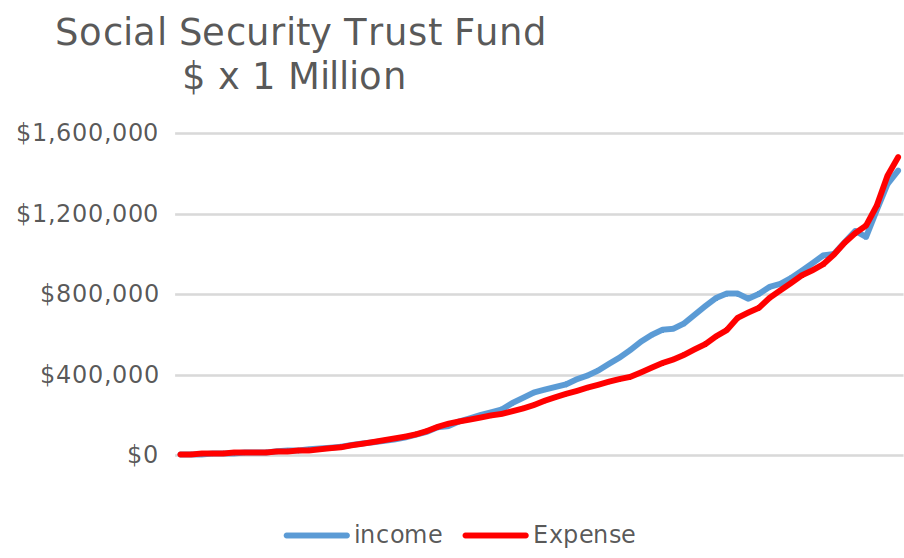

Here’s the status of the Social Security Trust Fund today. There is a balance, of about two years of benefits. But because income is now lower than expense, that will be depleted very quickly.

If the trust funds are exhausted, the programs will not be able to pay benefits at the current rates. For Social Security, it’s pretty straightforward what will happen: the only source of funds will be taxes paid by current workers, and those will only be sufficient to pay out about 70% of current Social Security benefits. That date is only eight years away. The longer we wait, the bigger a crisis we will face.

Where Does This Problem Originate?

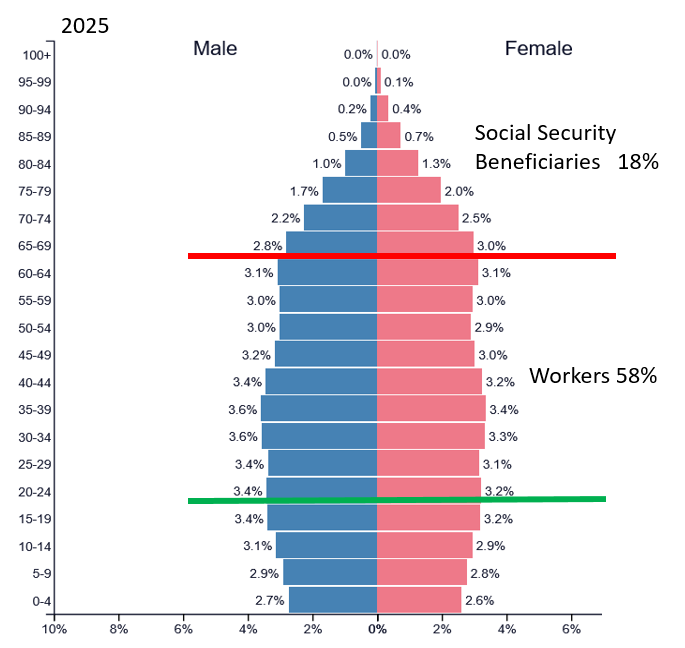

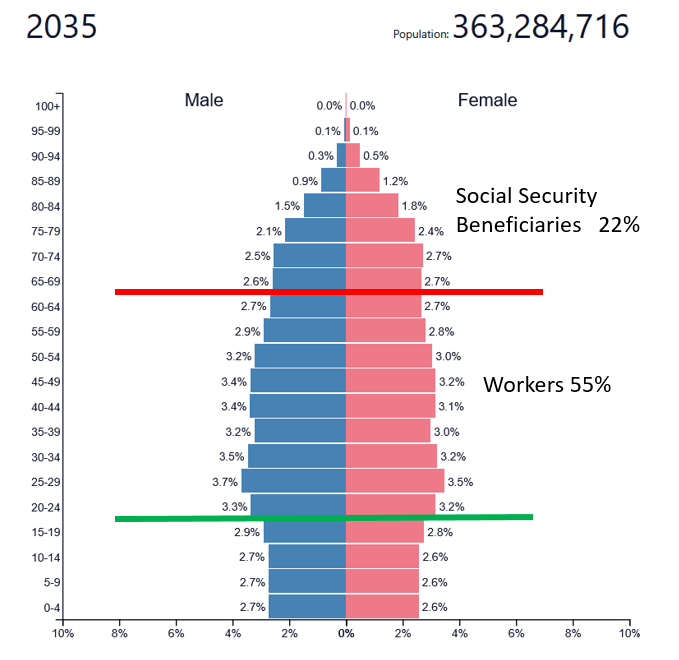

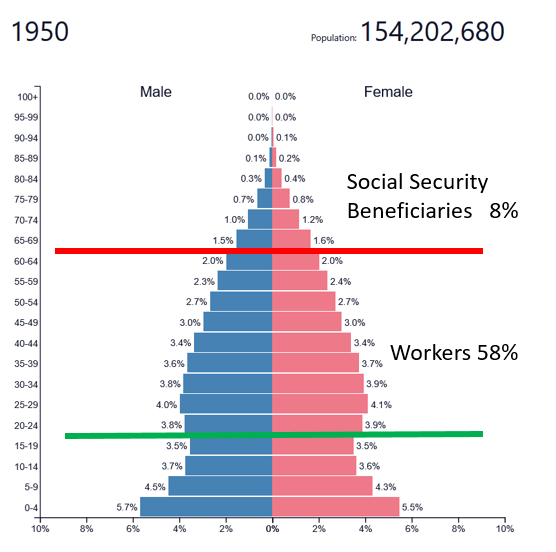

More than anything else, these problems are caused by the aging of the US population. This is not unique to the US – Japan, Korea, China, and most of Western Europe are also aging. The “population pyramid” shows how this is happening.

First, the population pyramid as it looked in 1953, when I was born. Note the bulge of 60% of all people in age 20 – 60, the prime working years, and only 8% on top to be supported over age 65. With a population shape like this, there were about seven people of working age for each retiree. So a small payroll tax could support a reasonable Social Security benefit. The big block of newborns at the bottom of this graph is the first wave of the baby boom, born immediately after World War 2.

https://www.populationpyramid.net

Now, look at the population pyramid today. Note that there are about the same number of people in each 5-year cohort all the way from age 5 to age 65. 58% of the population is working-age, and 18% are retirement age, meaning only about three people working for each retiree. Simply put, I didn’t have enough children (nor did others in my age cohort).

In ten years, more baby boomers will move into retirement, and only about 55% of the population will be working age and 22% will be eligible to draw Social Security benefits. With only 2.5 workers per retiree, the Social Security formula – today’s workers support yesterday’s workers now retired – won’t work with the current contribution rate.

The Multiple Roots of the Challenge for Social Security

The Social Security problem is pretty simple. We either need more money coming in or less money going out. There is no balance in the Trust Fund to invest at this point.

First, the “Trust Fund” balance has never been very high; it peaked at just under $3 trillion in 2020, less than three years of benefits. That’s because it started paying out when it was created.

Second, the number of workers per retiree is declining, because we having fewer offspring.

Third, we are living longer – in 1940, people who reached age 65 were expected to live an average of 12.5 more years; now it’s closer to 20 more years. This is the result of universal health care for retirees (Medicare), smoking cessation, and better emergency medicine, plus some frankly miraculous (if very expensive) medical treatments, from organ transplants to heart defibrillators (more on this in the Medicare article).

The problem is NOT that Social Security benefits rise with inflation. They do. But contributions into the Social Security Trust Fund have been rising at the same rate as inflation because wages have risen at about the same rate as inflation. There was a brief window, from 1985 to 2010, when contributions exceeded benefits, because the proportion of workers was high, and the Social Security Trust Fund grew a bit. But for the population pyramid problems shown above, the system that has worked for 90 years could continue.

These population problems were known decades ago. Fertility (live births per woman) has been declining for more than a century, from more than four to about 1.6 today. People living longer has been going on for centuries. These are not new problems.

Congress has increased the contribution rate several times, so that the amount coming in covers the amount going out, but not enough to produce a large cushion. The last increase, however, was in 1990 (that was the “read my lips” event for President George H.W. Bush). You can see in the graphic that the 1990 Social Security tax increase provided revenues greater than expenses. But that flipped in the past five years, and the gap will accelerate as more people retire, and fewer enter the workforce.

Part of the problem is the “cap” on Social Security. The way Social Security works, you pay in 12.4% of your income (half by the employer, half by the employee), but only up to a limit, currently $176,000 per year. That limit was put in place because there is a cap on benefits, and in theory, at least, Social Security is an insurance program. Today there are lots more rich people than before – doctors, lawyers, business executives, professional athletes, and technology workers. Since rich people won’t get higher benefits above a cap, it was considered fair that they not pay contributions above a threshold level of income. But this group now represents a larger share of total income than in the past (the rich are getting richer) meaning that more of total income is exempt from paying into Social Security.

So, What Is the Fix?

This is a difficult situation. Social Security was not designed for a world where there are more people not working (young + old) than working. We are approaching that point.

Let’s start with one thing advocated by some conservative groups that is NOT a fix for either Social Security or Medicare. They suggest investing the Social Security and Medicare Trust Funds in the stock market, not in government bonds. Yes, market returns are higher than Treasury bond returns. In fact, if the amounts I paid into Social Security since age 15 had been invested in the broad stock market, that account would now be worth about $3 million.

But that doesn’t work, because the Trust Funds have a very low balance and have always had a low balance. They have income approximately equal to expenditures, but the Trust Funds are mostly depleted now. So investing nothing at a higher return won’t help the crisis that is approaching in a few years. It could work for future retirees, but only by starving the funding that is the foundation of Social Security: contributions from today’s workers to support payments to yesterday’s workers.

Here are some ideas to fix Social Security. Most of these ideas come from a Social Security “calculator” produced by the Committee for a Responsible Federal Budget. You can play with other options here: https://www.crfb.org/socialsecurityreformer/

Raise Revenues

- Eliminate the Social Security “cap.” All workers, regardless of income, would pay the Social Security tax on all earnings. This alone closes 56% of the gap. This would convert Social Security from an “insurance” model to a “welfare” model.

- Apply the Social Security tax to interest, dividends, capital gains, and other forms of non-earned income, now exempt from Social Security tax. This closes another 20% of the gap, but also eliminates the façade that Social Security is insurance.

- Apply the Social Security tax (but not the Income Tax) to employee benefits, not just cash income. This would include taxing worker health benefits. This would close about another 15% of the gap.

- Tax all Social Security benefits as ordinary income. This would close about 20% of the gap. All retirees would pay more income tax, but the wealthiest would pay the highest share of their benefits back into Social Security because they are in higher tax brackets. But the Congress just went the opposite direction, giving seniors and extra $6,000/year standard deduction – to offset the tax we now pay on a portion of our Social Security benefits.

These four solutions alone would solve about 120% of the shortfall anticipated over the next 50 years. We don’t have to do all of them. But they would fundamentally change Social Security from an insurance program (benefits in retirement roughly equal to contributions while working) to an income transfer program (from rich to less-rich).

Reduce Benefits

The other way to balance the system is to reduce benefits being paid to workers. While many retirees are entirely dependent on their Social Security benefits, others have large retirement assets outside of Social Security. By reducing benefits to those with other income, the “outgo” is smaller, but the income is unchanged.

- Slow the growth in benefits for retirees in the upper 50% of total income. By reducing benefits for those who have significant income from outside Social Security, we can eliminate about 36% of the shortfall.

- Raise the retirement age to 69. Because so many fewer workers toil at the backbreaking work of the past, and because we have better medical care, some argue to raise the retirement age at which people begin collecting Social Security. The most radical of these is an immediate increase to 69. This would address 39% of the shortfall.

- Index cost of living increases to a different measure of inflation, and then means-test the COLA itself. Only those with real dependency on Social Security would receive COLA adjustments. This would address about 40% of the shortfall.

If we did all of these cost-reducing measures, we would close the Trust Fund gap, and the modified level of benefits could continue for decades.

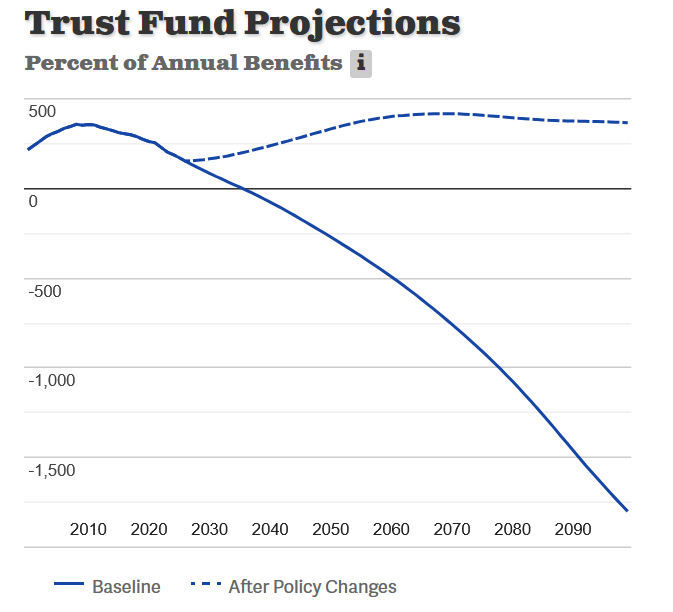

Or we could do a combination of revenue enhancements and benefit reductions. This shows what would happen if we did approximately half of the revenue enhancements and half of the benefit cuts described above. The solid line is the path we are on today, shown at the top of this article: the Trust fund will be exhausted in 2033. The dashed line is the effect of doing ALL of the revenue enhancement or ALL of the expenditure reductions, or half of each. The Trust Fund would remain positive, and recover to about the level in 2010 in a few decades.

The Politics of Social Security

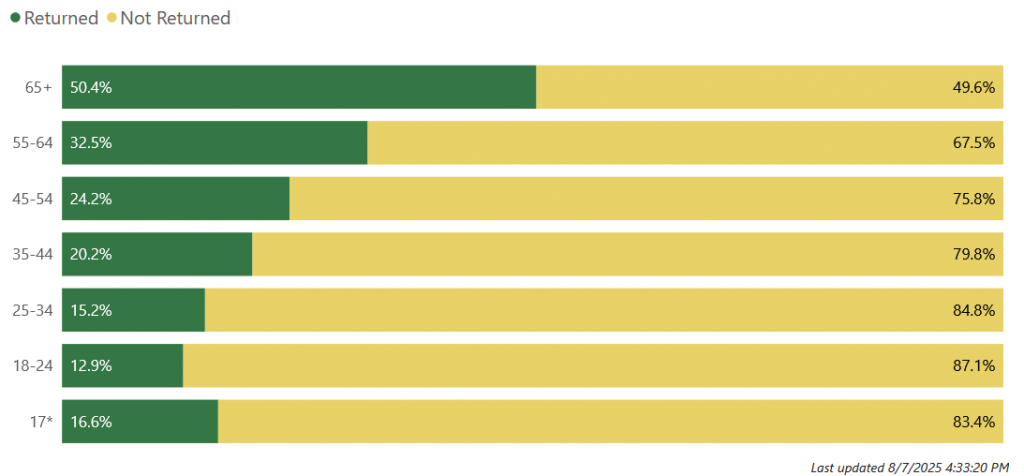

The politics of elected officials voting for change are a serious challenge. Older voters vote. In the 2024 Presidential Election, nearly all seniors voted, while only two-thirds of younger voters did. In the odd-year primary election, it is even more stark. In the election just concluded in 2025, only a tiny fraction of younger voters cast a ballot. [Note: this graph is on 8/7; it needs to be updated in a week with the final result.]

For a member of Congress to vote to cut benefits to existing retirees is considered politically very risky, because old people vote. At the same time, raising payroll taxes on existing workers is also very unpopular, because young workers are having a very hard time affording essentials like housing and health care. And raising taxes on the rich affects the campaign donors that most politicians rely on.

What I Think Will Happen

I fear that we are on a firm collision course with the exhaustion of the Social Security Trust Fund, and the “cliff” of benefits. I don’t expect solutions before 2029, and by then, the Trust Fund will be approaching zero. Then they will have to be fairly drastic solutions. I expect a mix of revenue increases, benefit cuts, and deficit spending will keep existing benefits to existing beneficiaries. These will slow the growth of benefits, impose some higher contributions on richer taxpayers, and there will probably be some federal borrowing to keep Social Security afloat. Put another way, the Congress will use a lot of duct tape to keep Social Security from falling apart. And that’s if things go well.

Jim Lazar is an economist, retired from a career in energy economics and utility regulation.