How does Medicare’s Solvency Problem Compare with Social Security’s?

Last month I looked at the challenges facing Social Security. There, the problem is relatively simple. The program is based on today’s workers paying retirement benefits for today’s retirees; the ratio of workers to retirees is changing (we are an aging society), and there are not enough workers to support all of the retirees.

The problem is similar for Medicare, but there are additional elements. First and foremost, the ratio of workers to beneficiaries is top-heavy with retirees, and becoming more so, and we elder folks consume more health care services. Second, the cost of health care is rising much faster than inflation. Third, more Medicare beneficiaries are choosing Medicare Advantage programs, which typically have more benefits and fewer costs for participants, but cost the program more.

This is offset by the fact that Congress did some major adjustments to impose higher costs on high-earning households for Medicare, something they have not done for Social Security. I’ll discuss past and possible future “fixes” to Medicare in the second part of this opinion piece, also published in this issue of WIP.

This article does not discuss Medicaid, the federal program for low-income people, including a huge number of seniors living in long-term care who have exhausted their financial assets. Medicaid is a topic for another article.

How Medicare is Funded

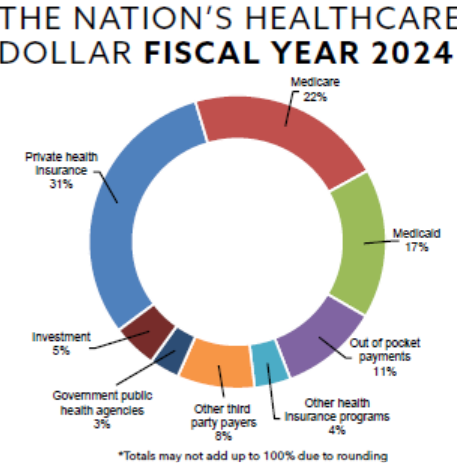

Each of Medicare and Medicaid accounts for about one-fifth of total U.S. health care spending. Private health insurance covers about a third, and a mix of other sources cover the balance of the nation’s total health care bill – which totals about 17% of the total US economy, larger than any sector except for housing.

The Trust Fund Concept

The “Medicare Trust Fund” is technically two separate federal repositories, into which taxes are deposited, and benefits are withdrawn. Each worker pays 2.9% of their wages and salaries into the Hospital Insurance fund. Most taxpayers do NOT pay into the Hospital Insurance Fund out of their other income – interest, dividends, or capital gains, but high earners do pay in. The second is the Supplemental Medical Insurance Fund. It is funded from premiums paid by enrollees, and from amounts appropriated by Congress from general taxes.

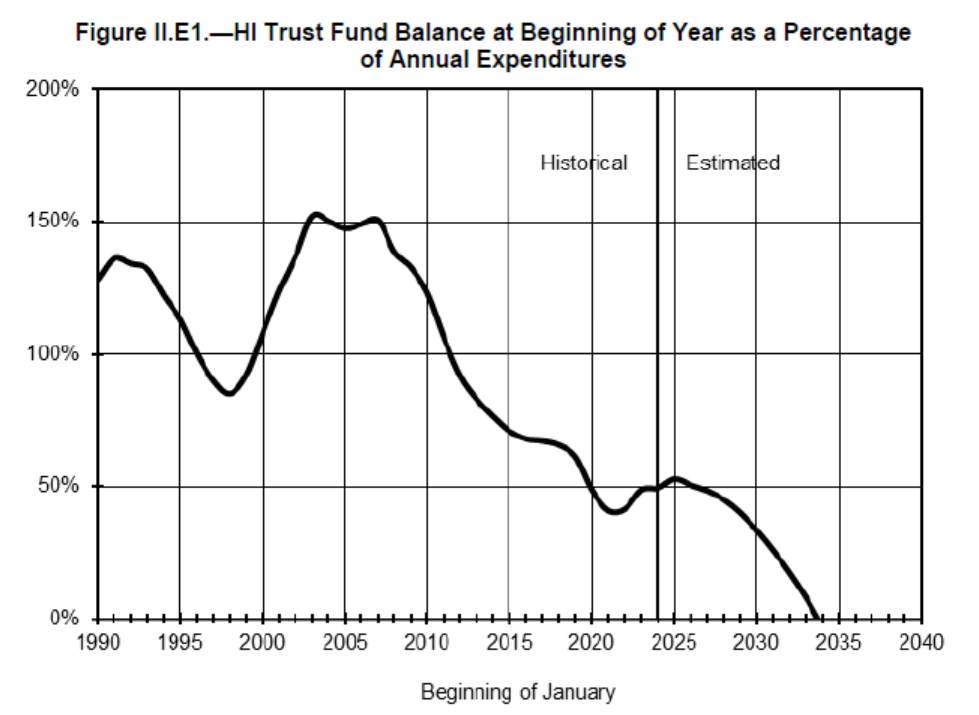

Here is the forecast in the 2025 Medicare Fund Trustees report, showing the hospital insurance trust fund exhausted by 2034. That’s just nine years from now. Until 2005, when the Boomers started to retire, the trust fund was doing fine. But with increasing numbers of retirees, and decreasing numbers of workers, the fund is in big trouble.

The Ratio of Workers to Retirees

This is the same problem that Social Security has, but it’s a little more pronounced. People are eligible for Social Security at age 62, but many defer taking benefits until they are 67 or even 70; by waiting, the monthly benefits are greater. Not so for Medicare; everyone who is eligible reaches eligibility at 65, and there are penalties if you DO NOT sign up immediately. And Medicare also covers certain other classes of beneficiaries: those on disability and those with end-stage renal disease who need kidney dialysis. So there are actually more Medicare beneficiaries than Social Security beneficiaries, but the same workers paying for it.

As we showed in the Social Security article, the share of the population in retirement is rising. Currently, about 18% of the population is receiving benefits, and 58% are working. By 2035, about 22% of the population will be receiving Medicare benefits. Simply put, my generation did not have enough kids to support us in this program.

Plus, people are living much longer, in part due to smoking cessation programs. That gives us more time for more things to wear out: knee and hip replacements, pacemakers, and even organ transplants drive up the Medicare bill.

The Cost of Health Care

Health care costs are rising significantly faster than general inflation. One reason is that we are an aging nation, as discussed above. Another is the amazing things we have learned to do to help people live quality lives as we age – I’ve had two knee replacements. A friend’s dad broke a hip and had surgery for that at 98, and received a pacemaker at 99. These gave him a relatively comfortable ride to the finish line.

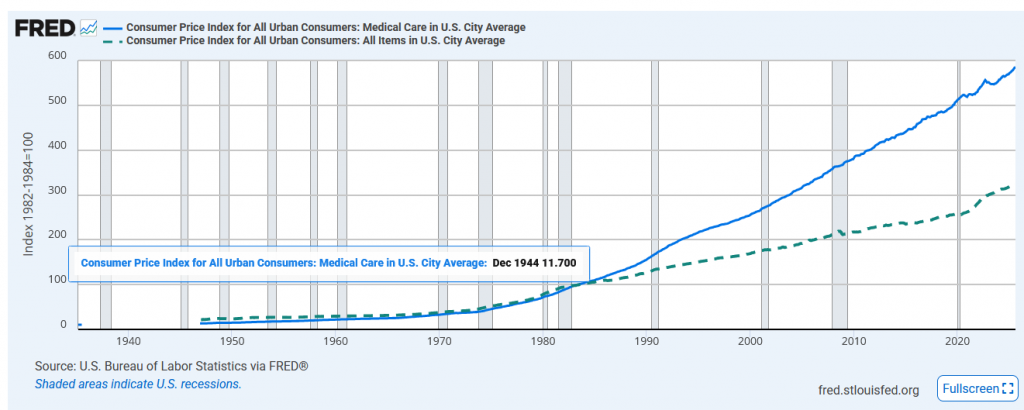

The solid line below shows the inflation rate for medical services, while the dotted line is the consumer price index for all goods and services. Up through 1980, both inflation rates were about the same; since 1980, medical inflation has been running about twice as fast as general inflation.

Medical care costs have gone up 5X since 1982, while general inflation is up “only” 3X. Part of this is that “other goods” have included a higher level of dependence on imports from China (televisions, computers, and other electronics have gone DOWN in cost). This holds the “other” inflation rate down, while most medical care costs are for doctors, nurses, physical therapists, and other U.S. based labor, without the improvements in productivity that we’ve seen in agriculture and manufacturing.

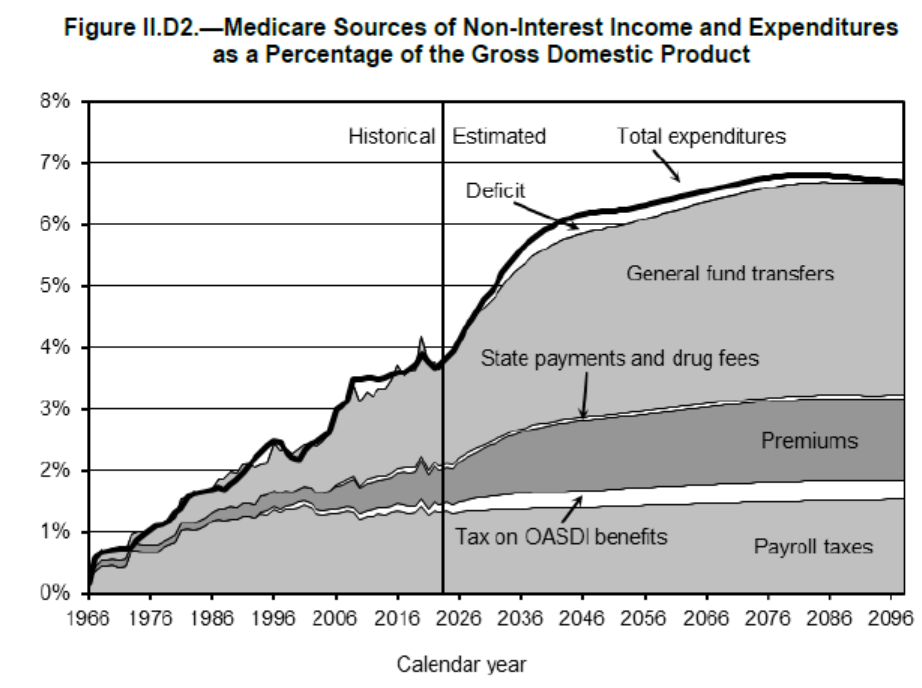

The costs of Medicare are going up sharply as a share of the total US economy. In 2000, Medicare costs were about 2% of the GDP. Today, it is closer to 4%, and this is expected to rise to about 7% by the end of this century. Here’s a table from the 2025 Medicare Fund Trustees report, showing the projected growth in Medicare revenues. The biggest increases are projected federal general fund transfers (meaning Medicare competes with the Defense Department and every other government program for funding).

Costs going up faster than inflation, and the labor force remaining stagnant or declining is a difficult future for funding Medicare.

Medicare Advantage: Problem or Answer?

The “original Medicare” paid 80% of costs, with patients responsible for the balance. This gave rise to “Medigap” insurance – supplemental programs that pay most or all of the patient’s share. There are different levels of Medigap, costing $100 to $400 per month.

In 1982, Medicare tried an experimental program, offering private insurers a fixed fee per patient, and let them manage the care to be more economical. In 1997, this experiment was made available to all Medicare recipients.

Today, some people consider Medicare Advantage a salvation – quality care for less money. Others consider it a threat: program managers limiting care to maximize profits. Both perspectives have a foundation.

About half of Medicare recipients have chosen a Medicare Advantage plan. In order to attract consumers, these often include benefits that traditional Medicare does not offer: dental, vision, and hearing aid coverage; health club membership; transportation to medical appointments, and more.

I have chosen Kaiser Medicare Advantage for a number of reasons. First, all of my care is “under one roof” with my doctor, specialists, surgeons, physical therapists, urgent care, immunizations and more all in one place (sometimes I get sent to specialists in Tacoma; I have the right to insist on a local referral, but mostly do not). I also like the YMCA membership, dental and vision coverage, and a few other features. My cost is significantly less than Traditional Medicare plus a Medigap policy, plus the dental, vision, and other benefits I get from Kaiser.

Kaiser is, of course, a non-profit rather than a traditional insurance company. But they DO manage my care, they DO deny me some things I’d like, and they DO pay their executives a boatload of money: $12.5 million in 2023 to CEO Gregory Adams, and ten other executives paid over $1 million per year.

In theory, Medicare Advantage should cost Medicare less, because it is a “full meal deal” package for integrated and managed care, while Traditional Medicare is a consumer-controlled all-you-can-eat plan with a-la-carte menu pricing. But it’s not worked out that way. The actual cost to Medicare has been slightly higher for Medicare Advantage. I’ve looked at several studies, and they seem to indicate:

- Traditional Medicare attracts people with fewer health conditions, because paying 20% out-of-pocket of a small annual health care bill is very little; Medicare Advantage attracts more people with complex medical issues who benefit from an “all you can eat” plan; Medicare does pay higher compensation for patients with complex medical conditions.

- Medicare Advantage includes a formula to pay more to care for people with multiple and complex health issues, and the program operators are very good at working that formula.

- Medicare Advantage plans include comprehensive drug cost coverage; traditional Medicare leaves the patient paying a bigger share of drug costs;

- If you combine the cost to Medicare for Traditional Medicare with the co-pays and the cost of Medigap insurance, the “combined” cost of traditional Medicare is higher than Medicare Advantage, but the cost paid by Medicare is a little higher.

- Outcomes are approximately equal. While Medicare Advantage results in some medical services being denied, Traditional Medicare requires that patients take more initiative to find the care they need, and not all do so.

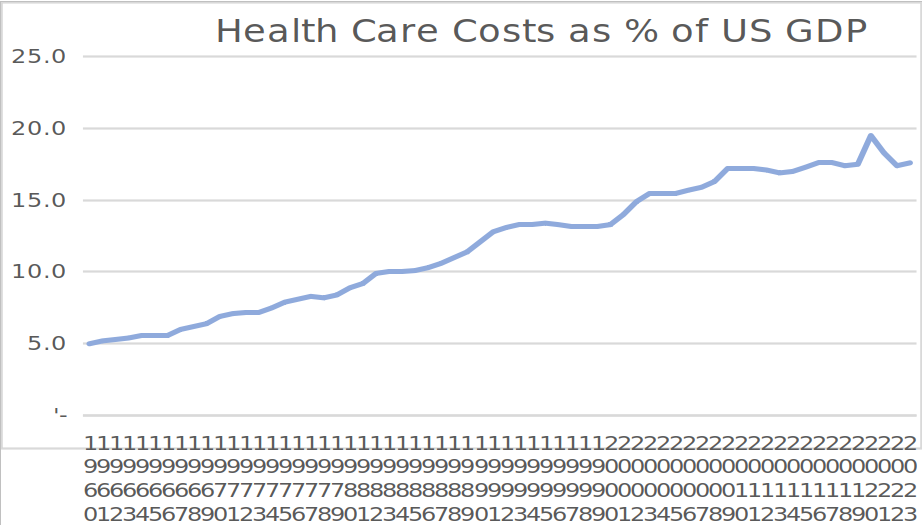

As an economist, I’m attracted to the concept of managed care, because the costs of health care have risen so much over my lifetime. When I was a graduate student, health care consumed about 7% of the US Gross Domestic Product. Now it’s up to about 17%.

Many of my friends find the concept of managed care offensive. Some have experienced insurance company denial of care they thought was necessary. Others have chosen Traditional Medicare because they can self-refer to the best doctors and clinics. My own experience is that Kaiser has approved what I need, and been willing to refer me to outside specialists when I need this. But if I had cancer, and wanted to have my care provided by the Seattle Cancer Care Alliance / Fred Hutchison Cancer Center, I might prefer to stay with Traditional Medicare.

The pros and cons of Medicare Advantage plans are just one piece of the dismal current state of Medicare. What solutions can Congress create so Medicare does not end just nine years from now? For discussion of past and possible future “fixes”, see Medicare: A Challenged Program – Part II – How Can Congress Keep it from Disappearing in 2034? by Jim Lazar in this issue of WIP.

Jim Lazar is an economist, retired from a career in energy economics and utility regulation.

Thank you for the overview. For what it’s worth, I went with a Medigap supplemental plan and added a separate drug and dental plan. The premiums are meaningfully higher and I have to deal with more insurers, but I thought that was worth it for three reasons.

First, I was able to keep more of my existing providers, which mattered given my medical situation. Second, I would rather pay predictable premiums than risk getting dinged to death with high out-of-pocket costs if I ever have major medical issues. Third, an older neighbor has really struggled to get adequate care for cancer with an Advantage program. HMOs can have advantages in better coordination, but I have seen too much cost cutting to feel much trust toward them.