BNSF claims safety is its number one priority while raking in the profits

Berkshire Hathaway is a conglomerate holding company whose subsidiaries are diverse and numerous. Chairman, president and CEO Warren Buffett has steered the company to a number five position on the Forbes Global 2000 list and continues to make corporate investment decisions. In 2013, the company’s gain in net worth was $34.2 billion and as of May 2014, it had a market capitalization of $309.1 billion. Omaha, Nebraska is home to its corporate headquarters, with 24 people on staff, while the company overall employs 330,000.

Structure of the conglomerate

There are four major sectors that operate within the company: insurance; utilities, railroad and energy; manufacturing, service and retail; and finance and financial products. Each of the four sectors has its own executives to make operational decisions, as Buffet prefers to focus on investing and acquisitions.

The insurance sector is the core operation of the company, stimulating growth through the use of its “float”. Insurers collect premiums upfront that eventually get paid as claims. Until they do, these collected premiums accumulate in huge pools that are referred to as float and can be invested for the insurance company’s benefit. Although specific premiums and claims fluctuate, float typically holds steady relative to premium volume. Berkshire insurance subsidies year-end float in 2013 was $77 billion, while underwriting profit was $3.1 billion. The major companies within this sector are Berkshire Hathaway Reinsurance Group, headed by Ajit Jain, General Re, led by Tad Montross and GEICO, managed by Tony Nicely.

The utilities, railroad and energy sector has two major subsidiaries. Burlington Northern Santa Fe (BNSF), led by Carl Ice and Matthew Rose, and MidAmerican Energy, headed by Greg Abel. MidAmerican is 89.8 percent owned by Berkshire and had net earnings in 2013 of $1.6 billion, $1.5 billion of which were applicable to Berkshire. BNSF’s 2013 net earnings were $3.8 billion and is owned wholly by Berkshire.

The manufacturing, service and retail operations involve many companies that are viewed financially as a single entity. Net earnings for this group in 2013 were $4.2 billion.

Lastly, the financial and financial products group is the smallest sector of the four. It includes XTRA and CORT, both rental companies headed by Jeff Pederson and Bill Franz. Clayton Homes, a leader in producing and financing manufactured homes, is under the direction of CEO Kevin Clayton. Pre-tax earnings in 2013 for this sector were $985 million.

Within the non-insurance groups lies what is referred to as the “Powerhouse Five”. The five increased its pre-tax earnings by $758 million in 2012, to a record $10.8 billion in 2013. The five are MidAmerican Energy, Burlington Northern Santa Fe(BNSF), ISCAR, Lubrizol and Marmon. In 2013, MidAmerican Energy acquired NV Energy, adding to its family of energy related companies that include Pacificorp, Northern Natural Gas and Kern River Gas Transmission.

The remaining four companies all have ties to the oil industry. BNSF Railways is the largest transporter of crude oil in North America. Marmon owns Union Tank Car Company. ISCAR is a “world class manufacture of cutting tools” that can be used by oil and gas equipment manufacturers. Lubrizol makes specialty chemicals, including fuel additives and refinery/oil field products.

Berkshire’s investment portfolio is extensive, but below is a table from Warren Buffett’s most recent letter to shareholders listing the fifteen highest yielding common stock investments for 2013.

According to its Owner’s Manual, Berkshire Hathaway measures its performance via per-share progress rather than by size. Because of the large amounts of capital it currently holds, it is more difficult for Berkshire Hathaway to perform as well as in earlier years when it held capital in smaller sums. Therefore, the company prefers to own a diversified group of businesses that generate cash and earn above average returns on capital, as opposed to owning parts of similar businesses through common stock. In the past three years Berkshire Hathaway acquired seven companies, its largest acquisition proving quite lucrative—BNSF Railway Company.

In October of 2009 while in Fort Worth on other business, Warren Buffett paid a visit to CEO Matthew Rose at BNSF. One day later, Buffett proposed a merger between the two companies. Berkshire already owned 22.6 percent of BNSF common stock—now Buffet would buy the rest for $34 billion, making it the largest deal in Berkshire’s history. In the press release issued a little over a week later, the merger was announced with Buffett’s description of the deal as an “all-in wager on the economic future of the United States.” The estimated value of the merger was set at $44 billion. Berkshire Hathaway added 65,000 new shareholders to its base. The merger was completed February 10, 2010.

BNSF and the virtual pipeline

BNSF Railway Company is the second largest freight transportation system in North America, following Union Pacific Railroad. Its rail network spans 32,500 route miles in 28 states and two Canadian provinces. Headquartered in Fort Worth, Texas, it employs 43,000 people and transports agricultural, consumer and industrial products as well as coal and crude oil. In 2013, it handled 10.1 million carloads and generated $22 billion in revenues.

On January 1, 2014, Carl Ice was promoted from president and COO to CEO, replacing Matthew Rose, who now holds the Executive Chairman role and works with managers on long-term organizational planning and public policy. In 2010, after the merger with Berkshire Hathaway was complete, Warren Buffett and Vice Chairman Charlie Munger said that Rose’s role at BNSF was a benefit of buying the railroad because they trusted and admired him. That admiration may have been forged by Rose’s ability to recognize and orchestrate the business opportunity that not only make BNSF the lead crude transport, but eventually lead to the crude by rail boom.

In 2009, Mark Papa, CEO of EOG Resources (formerly Enron Oil & Gas Co. and heavily invested in the fracking industry), started fracking in North Dakota to increase crude oil production. No existing pipeline was adequate to accommodate the volume that fracking was producing and trucking was not a viable means of transport. Although crude by rail was still in an experimental phase, Papa met with BNSF CEO Rose—the largest rail operator in North Dakota. Rose recalled in a 2013 Wall Street Journal article that BNSF had railed its own fuel “but nothing of this magnitude,” yet the two companies agreed to a transportation arrangement. EOG would build the first unit train facility in Stanley, North Dakota and would launch its first shipment via BNSF on December 31, 2009.

More big oil companies came calling and Rose explained to early customers that in order to compete with pipelines, BNSF would need to use long unit trains—100 or more cars carrying one commodity. They would also build big loop tracks into the oil companies’ facilities to make the process efficient. In the next few years, BNSF invested $540 million in North Dakota rail infrastructure and by 2012 had increased capacity to one million barrels of crude per day out of the Williston Basin in North Dakota.

Rose identified the need for the oil companies to get their product to markets; he found a way to compete with pipelines despite the higher price tag for railing crude. BNSF had the advantage because they could readily expand their infrastructure and had the flexibility to deliver to more markets, allowing oil companies to seek more buyers. The partnership with EOG Resources provided the blueprint for a convincing business plan that carried with it the promise of new clients. BNSF needed a large amount of capital to address expansion needs and Berkshire Hathaway saw a promising investment. Although it was characterized by Warren Buffett as patriotic commerce, it was the lure of new profits that was irresistible to the so-called “Oracle of Omaha”.

In 2014, Berkshire Hathaway has committed to a record $5 billion in capital investments for BNSF. $2.3 billion will be allocated for its rail network, $1.6 will be directed toward the acquisition of new trains and equipment, $900 million for terminal and intermodal expansion, and $200 million will pay for installing Positive Train Control (PTC)—a centralized communication system that helps keep trains from speeding and colliding. Part of the investment will go toward handling the 11 percent volume increase in industrial products, including crude oil.

While Rose has relinquished his CEO position to Carl Ice, the role of Chairman at BNSF will give him the opportunity to hone new skills. He is frequently shortlisted as Warren Buffett’s successor. Any loss of sleep he may have experienced from the stress of the merger has likely been justified in his mind. Yet, one may wonder if Matthew Rose experiences any insomnia over the more recent developments that have brought into question the safety of crude by rail.

BNSF In Washington State

Of the $5 billion that BNSF has committed to 2014 capital investments, $1 billion is being dedicated to the Northern Corridor, stretching from the Pacific Northwest to Chicago. As stated in a press release:

“Following our record capital investment in 2013 of $4 billion, we are making the most significant capital investment in our history of approximately $5 billion this year,” said Carl Ice. “Our capital investments along the Northern Corridor are critical to expanding our capacity to support the region’s rapidly growing economy, improving our ability to meet our customers’ expectations and ensuring our railroad remains the safest mode of ground transportation for freight.”

Outlined in the same press release, are the allocations for the state of Washington:

“BNSF plans to invest approximately $235 million in Washington to expand rail capacity, replace and maintain the network infrastructure, and continue the implementation of PTC technology.”

Expansion projects include:

Constructing second mainline track at various locations on the route between Cheney, Washington and Mesa, Washington.

Constructing two new staging tracks near Everett, Washington.

Installing a power switch at Anacortes, Washington.

Planned property improvements to enhance operations at the intermodal facilities in Spokane and South Seattle, Washington.

Maintenance projects include:

Surfacing and undercutting of more than 1,200 miles of track.

Replacing about 60 miles of rail.

Replacing more than 113,000 ties.”

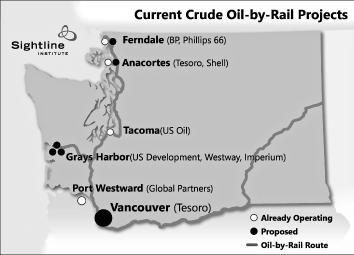

Above is a map created by the Sightline Institute of Seattle showing current and proposed oil terminals in Washington. According to Eric de Place, policy director for the Institute, approval of all six terminals would increase crude oil volume capacity to 858,800 barrels per day, exceeding the capacity of the Keystone XL pipeline. Current rail infrastructure is inadequate for such volumes, warranting the major investment in expansion by BNSF.

Three prominent BNSF figures in Washington are Johan Hellman, Executive Director, State Government Affairs for Washington, Oregon and British Columbia; Gus Melonas, Director of Public Affairs; and Courtney Wallace, Regional Director for Public Affairs. They have been representing their company well and are often found outside of their offices, located at 2454 Occidental Avenue South, Building 1A in Seattle. Mr. Hellman has been circulating the state, attending various council meetings to promote the expansion measures with an emphasis on the safety factor. As spokespersons, Mr. Melonas and Ms. Wallace make many appearances in the Washington media—both broadcast and print—to address current issues involving the railroad.

The Safety Mantra

Safety concerns may not have entered the 2009 conversation between Mark Papa and Matthew Rose, but currently, BNSF Railroad adamantly emphasizes its safety prioritization. Johan Hellman was quoted in a March 2014 Businessweek article saying, “Safety is our number one priority.” “For us, safety isn’t a slogan—safety is central to everything we do,” writes Daryl Ness, Northwest Division general manager of BNSF Railway, in his Bellingham Herald op-ed. “No matter what we carry, there is absolutely nothing more important than doing it safely,” writes Steve Nettleton, general manager of BNSF Railway’s Powder River Division, in his May 2014 Casper Star Tribune op-ed. Jason Jenkins, general manager of BNSF Chicago division concurs. “Safety is our primary concern”, he tells the LaCrosse Tribune readership in a June 2014 op-ed. Indeed, since the beginning of 2014, there has been a plethora of opinion articles found in papers across the country, penned by BNSF Railway managers, all making the same proclamations.

If one visits the BNSF website, it won’t take long to stumble upon the safety mantra. On its Safety and Security page it states, “We foster a culture that makes safety our highest priority and provides continuous self-examination as to the effectiveness of our safety process and performance.” The second sentence of Carl Ice’s message in the 2013 Annual Review read, “Nothing is more important to us than safety.” Company prepared PowerPoint presentations tout 2013 as its safest year to date and share its philosophy that every accident is preventable. Annual capital expenditure figures are charted in the billions and typically pair safety with expansion, but what’s missing from the equation is adequacy. Will these measures be enough to provide the safety that BNFS promises and the public deserves? More disturbing, is this authentic concern or a facade used to quash public opposition?

RBN Energy, LLC provides consulting services to the energy industry. On February 5, 2013, prior to derailments in Quebec, Alabama, North Dakota and Virginia, Sandy Fielden posted an article titled, “Crude Loves Rocking Rail—The Year of the Tank Car”. It details the crude by rail boom from an energy analyst’s perspective. Near the end of the article, Fielden includes this prophetic paragraph: “Safety Risks: One issue that has so far thankfully not received a great deal of attention is the safety risk of moving crude by rail. A recent Manhattan Institute report determined that rail accidents occur 34 times more frequently than pipeline ones for every ton of crude or other hazardous material shipped comparable distances. The Association of American Railroads (AAR) acknowledges the likelihood of a rail accident is double or triple the chance of a pipeline problem. A single incident could easily change the entire debate about rail versus pipeline safety.”

The Manhattan Institute is a think tank that is partly funded by such oil interests as Exxon Mobil and the Koch Family Foundation, proponents of the pipelines, making their methodology suspect to bias. However, the AAR represents North America’s freight railroads and Amtrak. Their acknowledgement carries greater credibility.

In February of 2014, BNSF took the unusual step toward reinforcing the safety mantra. The railroad announced that it would purchase 5000 next-generation tank cars, claiming a desire to stimulate the industry toward the replacement of vulnerable DOT-111 cars that are currently used for crude transport. According to the trade association Railway Supply Institute, of the 39,000 DOT-111’s transporting crude oil, less than one-third are new or retrofitted to meet the industry’s 2011 voluntary safety guidelines. While railroads typically do not own the tank cars, only the engines and the track, BNSF has solicited bids from major rail car manufacturers for the 5000 cars. By some estimations this could cost the company nearly $1 billion. During an April workshop with the Vancouver City Council, Patrick Brady, Director of Hazardous Materials, Special Operations for BNSF, was asked by a council member for the estimated time frame until all tank cars moving through Vancouver would be the new models. Brady said the company hoped that would happen in five to seven years. Considering four significant derailments occurred in a time span of less than one year, the context of adequacy once again arises.

Besides repeating the safety mantra, Jason Jenkins’ op-ed published in the LaCrosse Tribune also enlightened readers to the fact that the railroad doesn’t own tank cars, but was “actively lobbying” to increase the required safety standards for the cars.

Ajay, a Tribune reader, challenged Mr. Jenkins’ argument with some hard hitting reality, revealing the mantra’s vulnerability. Ajay posted, “If BNSF’s number one priority is safety, then BNSF should refuse to ship highly volatile, Bakken crude oil using substandard DOT-111 tank cars. Yes, we get it. We understand that you don’t own the tank cars. But you do (glady) take millions of dollars from the oil companies who lease these substandard tank cars to transport this oil through La Crosse. Maybe BNSF’s number two goal is safety, but the number one goal is profit. Get real. It’s all about money! If BNSF’s number one goal is safety, then take a stand and ban all unsafe substandard DOT-111 tank cars from all of your lines that criss-cross the country.”

Perhaps that challenge would be more aptly posed to Jason Jenkins’ superiors. What say you, Matthew Rose? Still investing in America, Mr. Buffett, risking human life every day as your “safety is number one” railroad continues to use compromised oil tankers? The American public can see through your false patriotism. You are no Uncle Sam.

J. C. Kadin writes from her home state of Wisconsin, where she became involved in organizing during its Uprising.

Be First to Comment